Business Insurance in and around Alexandria

Researching coverage for your business? Look no further than State Farm agent Amy Christopherson!

Insure your business, intentionally

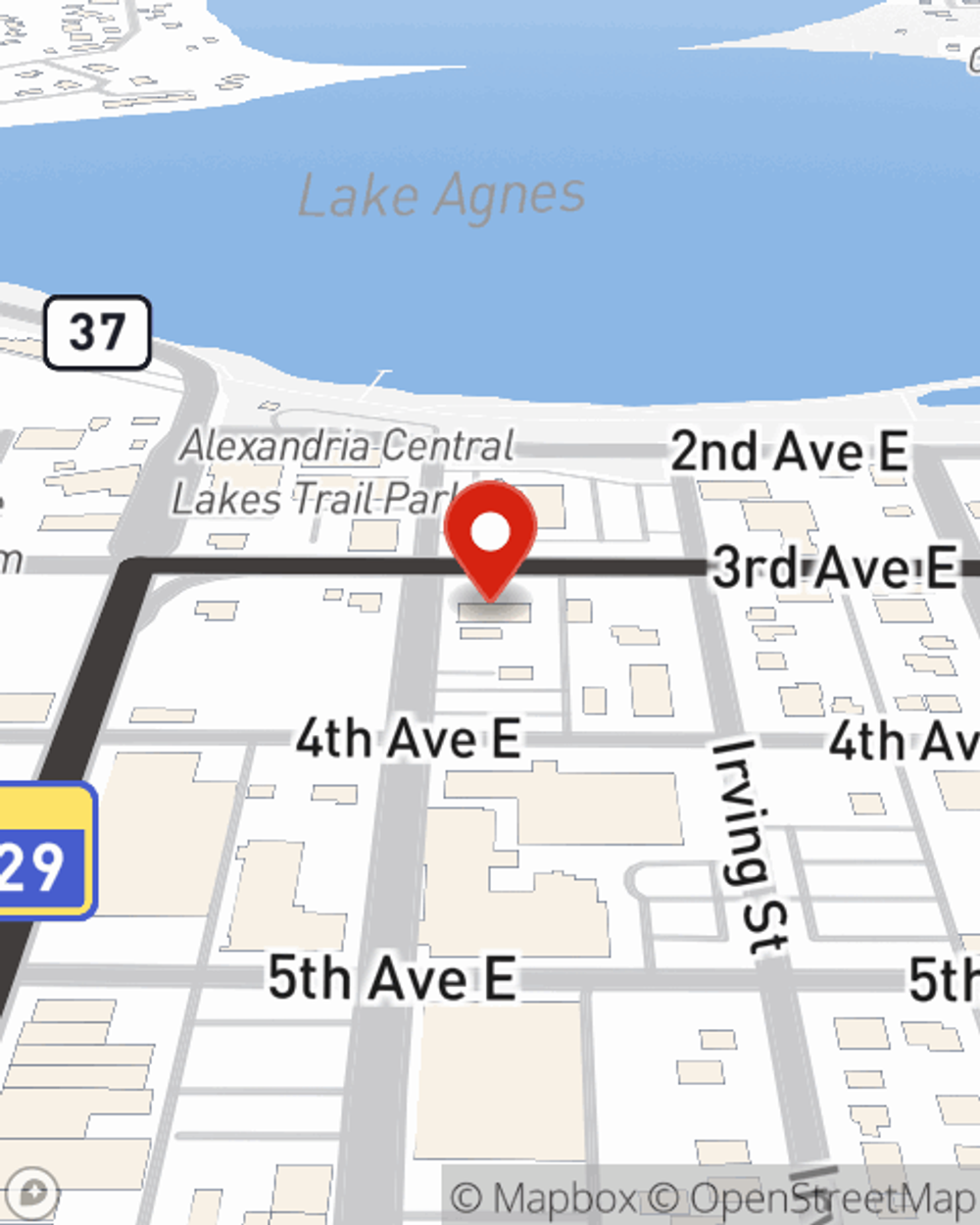

- Alexandria, MN

- Osakis, MN

- Brandon, MN

- Parkers Prairie, MN

- All of Minnesota

- All of South Dakota

- All of North Dakota

Help Protect Your Business With State Farm.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a veterinarian, a home cleaning service, a clock shop, or other.

Researching coverage for your business? Look no further than State Farm agent Amy Christopherson!

Insure your business, intentionally

Customizable Coverage For Your Business

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, commercial auto or builders risk insurance.

The right coverages can help keep your business safe. Consider visiting State Farm agent Amy Christopherson's office today to learn about your options and get started!

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Amy Christopherson

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.